What Annual Rate of Interest Compounded Continuously is Required to Double an Investment in 6 Years

This compound interest calculator is a tool to help you estimate how much money you will earn on your deposit. In order to make smart financial decisions, you need to be able to foresee the final result. That's why it's worth knowing how to calculate compound interest. The most common real-life application of the compound interest formula is a regular savings calculation.

Read on to find answers to the following questions:

- What is the interest rate definition?

- What is the compound interest definition and what is the compound interest formula?

- What is a difference between simple and compound interest rates?

- How to calculate compound interest?

- What are the most common compounding frequencies?

You may also want to check our student loan calculator where you can make a projection on your expenses and study the effect of different student loan options on your budget.

Interest rate definition

In finance, interest rate is defined as the amount charged by a lender to a borrower for the use of an asset. So, for the borrower the interest rate is the cost of the debt, while for the lender it is the rate of return.

Note that in the case where you make a deposit into a bank (e.g., put money in your savings account), you have, from a financial perspective, lent money to the bank. In such a case the interest rate reflects your profit.

The interest rate is commonly expressed as a percentage of the principal amount (outstanding loan or value of deposit). Usually, it is presented on an annual basis, which is known as the annual percentage yield (APY) or effective annual rate (EAR).

What is the compound interest definition?

Generally, compound interest is defined as interest that is earned not solely on the initial amount invested but also on any further interest. In other words, compound interest is the interest on both the initial principal and the interest which has been accumulated on this principle so far. Therefore, the fundamental characteristic of compound interest is that interest itself earns interest. This concept of adding a carrying charge makes a deposit or loan grow at a faster rate.

You can use the compound interest equation to find the value of an investment after a specified period or estimate the rate you have earned when buying and selling some investments. It also allows you to answer some other questions, such as how long it will take to double your investment.

We will answer these questions in the examples below.

Simple vs. compound interest

You should know that simple interest is something different than the compound interest. It is calculated only on the initial sum of money. On the other hand, compound interest is the interest on the initial principal plus the interest which has been accumulated.

Compounding frequency

Most financial advisors will tell you that the compound frequency is the compounding periods in a year. But if you are not sure what compounding is, this definition will be meaningless to you… To understand this term you should know that compounding frequency is an answer to the question How often is the interest added to the principal each year? In other words, compounding frequency is the time period after which the interest will be calculated on top of the initial amount.

For example:

- annual (1/Yr) compounding has a compounding frequency of one,

- quarterly (4/Yr) compounding has a compounding frequency of four,

- monthly (12/Yr) compounding has a compounding frequency of twelve.

Note that the greater the compounding frequency is, the greater the final balance. However, even when the frequency is unusually high, the final value can't rise above a particular limit. To understand the math behind this, check out our natural logarithm calculator.

As the main focus of the calculator is the compounding mechanism, we designed a chart where you can follow the progress of the annual interest balances visually. If you choose a higher than yearly compounding frequency, the diagram will display the resulting extra or additional part of interest gained over yearly compounding by the higher frequency. Thus, in this way, you can easily observe the real power of compounding.

Compound interest formula

The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. It's quite complex because it takes into consideration not only the annual interest rate and the number of years but also the number of times the interest is compounded per year.

The formula for annual compound interest is as follows:

FV = P (1+ r/m)^mt

Where:

- FV - the future value of the investment, in our calculator it is the final balance

- P - the initial balance (the value of the investment)

- r - the annual interest rate (in decimal)

- m - the number of times the interest is compounded per year (compounding frequency)

- t - the numbers of years the money is invested for

It is worth knowing that when the compounding period is one (m = 1) then the interest rate (r) is call the CAGR (compound annual growth rate).

How to calculate compound interest

Actually, you don't need to memorize the compound interest formula from the previous section to estimate the future value of your investment. In fact, you don't even need to know how to calculate compound interest! Thanks to our compound interest calculator you can do it in just a few seconds, whenever and wherever you want. (NB: Have you already tried the mobile version of our calculators?)

With our smart calculator, all you need to calculate the future value of your investment is to fill the appropriate fields:

- Main properties

- Initial balance - the amount of money you are going to invest or deposit.

- Interest rate – the interest rate expressed on a yearly basis.

- Term – the time frame you are going to invest money.

- Compound frequency – in this field, you should select how often the compounding applies to your balance. Usually, the interest added to the principal balance daily, weekly, monthly, quarterly, semi-annually, or yearly. But you may set it as continuous compounding as well, which is the theoretical limit for the compounding frequency. In this case, the number of periods when compounding occurs is infinite.

- Additional deposits

- How much - the amount you are planning to deposit on the account.

- How often - you can choose the frequency of the additional deposit here.

- When - you should select the timing of the transaction of the additional deposit. More specifically, you may place the money to the account at the beginning or at the end of the periods.

- Growth rate of deposit - this option allows you to set a growth rate of the additional deposit. This option can be particularly useful in the long term when your income possibly increases due, for example, to inflation and/or promotions.

That's it! In a flash, our compound interest calculator makes all necessary computations for you and gives you the results.

The two main results are:

- the final balance, that is the total amount of money you will receive after the specified period, and

- the total interest, which is the total compounded interest payment.

In case you set the additional deposit field, we gave you the results for the compounded initial balance and compounded additional balance.

Besides, we also show you their contribution to the total interest amount, namely, interest on the initial balance and interest on the additional deposit.

Compound interest examples

- Do you want to understand the compound interest equation?

- Are you curious about the fine details of how to calculate the compound interest rate?

- Are you wondering how our calculator works?

- Do you need to know how to interpret the results of compound interest calculation?

- Are you interested in all possible uses of the compound interest formula?

The following examples are there to try and help you answer these questions. We believe that after studying them, you won't have any trouble with the understanding and practical implementation of compound interest.

Example 1 – basic calculation of the value of an investment

The first example is the simplest, in which we calculate the future value of an initial investment.

Question

You invest $10,000 for 10 years at the annual interest rate of 5%. The interest rate is compounded yearly. What will be the value of your investment after 10 years?

Solution

Firstly let's determine what values are given, and what we need to find. We know that you are going to invest $10,000 - this is your initial balance P, and the number of years you are going to invest money is 10. Moreover, the interest rate r is equal to 5%, and the interest is compounded on a yearly basis, so the m in the compound interest formula is equal to 1.

We want to calculate the amount of money you will receive from this investment, that is, we want to find the future value FV of your investment.

To count it, we need to plug in the appropriate numbers into the compound interest formula:

FV = 10,000 * (1 + 0.05/1) ^ (10*1) = 10,000 * 1.628895 = 16,288.95

Answer

The value of your investment after 10 years will be $16,288.95.

Your profit will be FV - P. It is $16,288.95 - $10,000.00 = $6,288.95.

Note that when doing calculations you must be very careful with your rounding. You shouldn't do too much until the very end. Otherwise, your answer may be incorrect. The accuracy is dependent on the values you are computing. For standard calculations, six digits after the decimal point should be enough.

Example 2 - complex calculation of the value of an investment

In the second example, we calculate the future value of an initial investment in which interest is compounded monthly.

Question

You invest $10,000 at the annual interest rate of 5%. The interest rate is compounded monthly. What will be the value of your investment after 10 years?

Solution

Like in the first example, we should determine the values first. The initial balance P is $10,000, the number of years you are going to invest money is 10, the interest rate r is equal to 5%, and the compounding frequency m is 12. We need to obtain the future value FV of the investment.

Let's plug in the appropriate numbers in the compound interest formula:

FV = 10,000 * (1 + 0.05/12) ^ (10*12) = 10,000 * 1.004167 ^ 120 = 10,000 * 1.647009 = 16,470.09

Answer

The value of your investment after 10 years will be $16,470.09.

Your profit will be FV - P. It is $16,470.09 - $10,000.00 = $6,470.09.

Did you notice that this example is quite similar to the first one? Actually, the only difference is the compounding frequency. Note that, only thanks to more frequent compounding this time you will earn $181.14 more during the same period! ($6,470.09 - $6,288.95 = $181.14)

Example 3 - Calculating the interest rate of an investment using the compound interest formula

Now, let's try a different type of question that can be answered using the compound interest formula. This time, some basic algebra transformations will be required. In this example, we will consider a situation in which we know the initial balance, final balance, number of years and compounding frequency but we are asked to calculate the interest rate. This type of calculation may be applied in a situation where you want to determine the rate earned when buying and selling an asset (e.g., property) which you are using as an investment.

Data and question

You bought an original painting for $2,000. Six years later, you sold this painting for $3,000. Assuming that the painting is viewed as an investment, what annual rate did you earn?

Solution

Firstly, let's determine the given values. The initial balance P is $2,000 and final balance FV is $3,000. The time horizon of the investment 6 years and the frequency of the computing is 1. This time, we need to compute the interest rate r.

Let's try to plug this numbers in the basic compound interest formula:

3,000 = 2,000 * (1 + r/1) ^ (6*1)

So:

3,000 = 2,000 * (1 + r) ^ (6)

We can solve this equation using the following steps:

Divide both sides by 2000

3,000 / 2,000= (1 + r) ^ (6)

Raise both sides to the 1/6th power

(3,000 / 2,000) ^ (1 / 6) = (1 + r)

Subtract 1 from both sides

(3,000 / 2,000) ^ (1 / 6) – 1 = r

Finally solve for r

r = 1.5 ^ 0.166667 – 1 = 1.069913 - 1 = 0.069913 = 6.9913%

Answer

In this example you earned $1,000 out of the initial investment of $2,000 within the six years, meaning that your annual rate was equal to 6.9913%.

As you can see this time, the formula is not very simple and requires a lot of calculations. That's why it's worth testing our compound interest calculator, which solves the same equations in an instant, saving you time and effort.

Example 4 - Calculating the doubling time of an investment using the compound interest formula

Have you ever wondered how many years it will take for your investment to double its value? Besides its other capabilities, our calculator can help you to answer this question. To understand how it does it, let's take a look at the following example.

Data and question

You put $1,000 on your saving account. Assuming that the interest rate is equal to 4% and it is compounded yearly. Find the number of years after which the initial balance will double.

Solution

The given values are as follows: the initial balance P is $1,000 and final balance FV is 2 * $1,000 = $2,000, and the interest rate r is 4%. The frequency of the computing is 1. The time horizon of the investment t is unknown.

Let's start with the basic compound interest equation:

FV = P (1 + r/m)^mt

Knowing that m = 1, r = 4%, and 'FV = 2 * P we can write

2P = P (1 + 0.04) ^ t

Which could be written as

2P = P (1.04) ^ t

Divide both sides by P (P mustn't be 0!)

2 = 1.04 ^ t

To solve for t, you need take the natural log (ln), of both sides:

ln(2) = t * ln(1.04)

So

t = ln(2) / ln(1.04) = 0.693147 / 0.039221 = 17.67

Answer

In our example it takes 18 years (18 is the nearest integer that is higher than 17.67) to double the initial investment.

Have you noticed that in the above solution we didn't even need to know the initial and final balances of the investment? It is thanks to the simplification we made in the third step (Divide both sides by P). However, when using our compound interest rate calculator, you will need to provide this information in the appropriate fields. Don't worry if you just want to find the time in which the given interest rate would double your investment, just type in any numbers (for example 1 and 2).

It is also worth knowing that exactly the same calculations may be used to compute when the investment would triple (or multiply by any number in fact). All you need to do is just use a different multiple of P in the second step of the above example. You can also do it with our calculator.

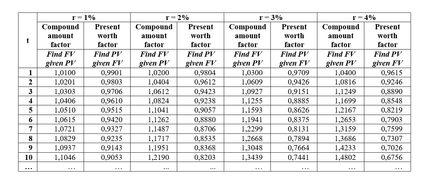

Compound interest table

Compound interest tables were used everyday, before the era of calculators, personal computers, spreadsheets, and unbelievable solutions provided by Omni Calculator 😂. The tables were designed to make the financial calculations simpler and faster (yes, really…). They are included in many older financial textbooks as an appendix.

Below, you can see what a compound interest table looks like.

Using the data provided in the compound interest table you can calculate the final balance of your investment. All you need to know is that the column compound amount factor shows the value of the factor (1 + r)^t for the respective interest rate (first row) and t (first column). So to calculate the final balance of the investment you need to multiply the initial balance by the appropriate value from the table.

Note that the values from the column Present worth factor are used to compute the present value of the investment when you know its future value.

Obviously, this is only a basic example of a compound interest table. In fact, they are usually much, much larger, as they contain more periods t various interest rates r and different compounding frequencies m... You had to flip through dozens of pages to find the appropriate value of compound amount factor or present worth factor.

With your new knowledge of how the world of financial calculations looked before Omni Calculator, do you enjoy our tool? Why not share it with your friends? Let them know about Omni! If you want to be financially smart, you can also try our other finance calculators.

Additional Information

Now that you know how to calculate compound interest, it's high time you found other applications to help you make the greatest profit from your investments:

To compare bank offers which have different compounding periods, we need to calculate the Annual Percentage Yield, also called Effective Annual Rate (EAR). This value tells us how much profit we will earn within a year. The most comfortable way to figure it out is using the APY calculator, which estimates the EAR from the interest rate and compounding frequency.

If you want to find out how long it would take for something to increase by n%, you can use our rule of 72 calculator. This tool enables you to check how much time you need to double your investment even quicker than the compound interest rate calculator.

You may also be interested in the credit card payoff calculator, which allows you to estimate how long it will take until you are completely debt-free.

Another interesting calculator is our cap rate calculator which determines the rate of return on your real estate property purchase.

We also suggest you try the lease calculator which helps you determine the monthly and total payments for a lease.

If you're looking to finance the purchase of a new recreational vehicle (RV), our RV loan calculator makes it simple to work out what the best deal will be for you.

The depreciation calculator enables you to use three different methods to estimate how fast the value of your asset decreases over time.

And finally, why not to try our dream come true calculator.

which answers the question: how long do you have to save to afford your dream?

Source: https://www.omnicalculator.com/finance/compound-interest

0 Response to "What Annual Rate of Interest Compounded Continuously is Required to Double an Investment in 6 Years"

Post a Comment